Share This Article

Manually processing bank statements is one of the most time-consuming and error-prone tasks in bookkeeping. For accountants juggling multiple clients, small business owners managing tight budgets, and solopreneurs wearing all the hats, the hours spent on data entry, categorization, and reconciliation add up quickly, diverting focus from core business activities. What if there was a way to automate this tedious process, ensuring accuracy and freeing up valuable time? Enter Smart Clerk, an AI-powered bookkeeping tool designed specifically to process bank statements and streamline your accounting workflow.

The Burden of Manual Bookkeeping: Why Bank Statements Bog You Down

Traditional bookkeeping often involves printing out bank statements or painstakingly downloading CSV files, only to manually type each transaction into accounting software or spreadsheets. This process isn’t just slow; it’s fraught with potential pitfalls:

- Time Drain: Accountants can spend hours per client each month just on statement processing. For small businesses and solopreneurs, this is time stolen from sales, marketing, or product development.

- Costly Errors: Manual data entry is susceptible to typos, omissions, and miscategorizations. These errors can lead to inaccurate financial reports, flawed business decisions, and potential issues during tax season.

- Reconciliation Nightmares: Matching bank statement entries with internal records can be a complex puzzle, especially when dealing with high transaction volumes or discrepancies. Finding and fixing these issues manually is a major headache.

- Inconsistent Categorization: Applying consistent categories to transactions manually is challenging, especially when dealing with ambiguous vendor names or varied spending patterns. This inconsistency undermines the accuracy of financial reports like the Profit and Loss statement.

- Delayed Insights: The lag time associated with manual processing means financial data is often outdated by the time it’s compiled, hindering timely decision-making.

These challenges aren’t just minor inconveniences; they represent significant operational friction, impacting efficiency, accuracy, and ultimately, the financial health of a business. Relying solely on tools like Quickbooks, Wave Accounting, or Xero might help with overall accounting, but the initial hurdle of getting statement data *into* the system efficiently often remains.

Introducing Smart Clerk: AI-Powered Bookkeeping Automation

This is where Smart Clerk steps in, offering a targeted solution to the bank statement bottleneck. It’s an AI bookkeeping tool specifically engineered to instantly convert bank and credit card statements into organized, accountant-ready reports. Instead of manual entry, you simply upload your PDF statements, and Smart Clerk’s AI takes over.

Think of it as giving your bookkeeping process a significant upgrade. While comprehensive accounting platforms manage the big picture, Smart Clerk tackles the critical, often tedious, first step: extracting and organizing raw transaction data with speed and precision. This focus makes it an excellent supplementary tool for accountants or a powerful standalone solution for businesses primarily needing efficient statement processing and reporting.

How Smart Clerk Transforms Statement Processing: Key Features & Benefits

Smart Clerk leverages artificial intelligence to automate several key bookkeeping tasks traditionally associated with bank statements. Here’s how it works and the benefits it delivers:

AI-Powered Statement Processing

Feature: Upload PDF bank or credit card statements directly into the platform. The AI instantly reads and extracts every transaction detail – date, description, amount.

Benefit: Eliminates manual data entry entirely. What used to take hours can now be done in minutes, freeing up significant time for accountants, small business owners, and solopreneurs to focus on higher-value activities.

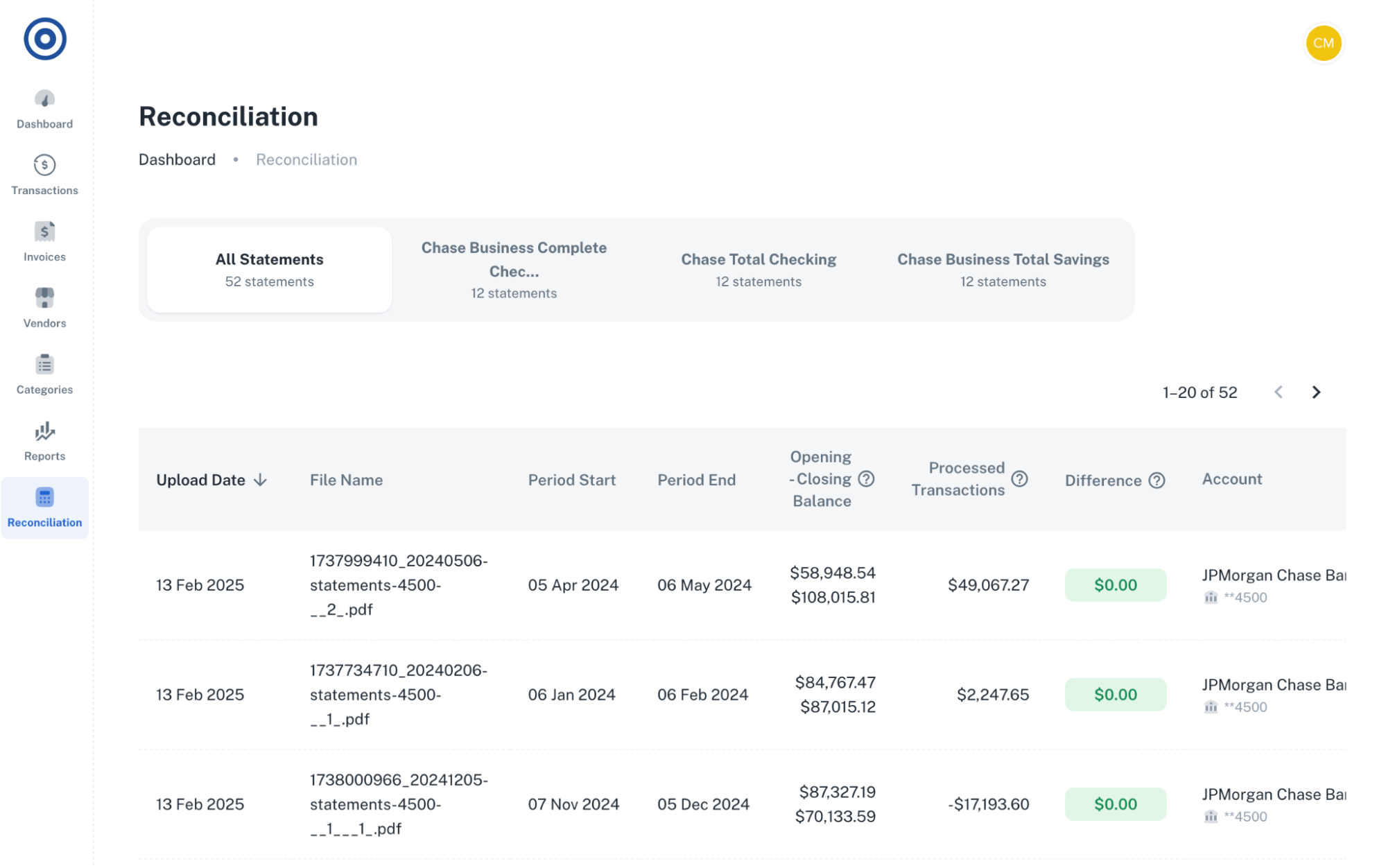

Reconciliation Module

Feature: Smart Clerk includes a dedicated module to help detect and resolve discrepancies between the statement data and your expectations or other records.

Benefit: Simplifies the reconciliation process. Quickly identify potential errors or mismatches, ensuring the accuracy of your financial data without the usual manual cross-checking nightmare.

Profit and Loss Statement Generation

Feature: Generate clear Profit and Loss (P&L) statements with just a few clicks. View month-by-month spending broken down by category or vendor.

Benefit: Gain immediate financial insights. Understand your business’s financial performance without needing deep accounting expertise. Easily track spending patterns and identify areas for potential savings.

Automatic Transaction Categorization

Feature: The AI automatically suggests categories for each transaction. Users can accept suggestions, change categories, and create custom rules for future categorization.

Benefit: Ensures consistent and accurate categorization. Save time assigning categories and improve the reliability of your financial reports. Custom rules adapt the AI to your specific business needs.

Vendor Management

Feature: Smart Clerk intelligently identifies vendors, even consolidating different variations of vendor names that might appear on statements.

Benefit: Provides clean and consistent vendor data. Easily track spending per vendor, monitor relationships, and spot unusual transactions without manually cleaning up vendor names.

Export and Share

Feature: Export your processed data and financial reports (like the P&L) to Excel format.

Benefit: Seamless collaboration and tax preparation. Easily share clean, organized data with your accountant or use it for further analysis. Makes tax season significantly less stressful.

Pros and Cons of Smart Clerk

Like any tool, Smart Clerk has its strengths and considerations:

Pros:

- Significant Time Savings: AI automation drastically reduces manual data entry for bank statements.

- Improved Accuracy: Minimizes human error in transcription and categorization.

- Ease of Use: Simple interface focused on uploading statements and reviewing results.

- Focused Solution: Excels specifically at processing PDF bank/credit card statements.

- Quick Reporting: Fast generation of P&L statements for immediate insights.

- Accountant-Ready Exports: Clean Excel exports simplify collaboration and tax filing.

Cons:

- PDF Focus: Primarily designed for PDF statement uploads; direct bank feeds may not be its core function (unlike comprehensive platforms like Quickbooks or Xero).

- AI Learning Curve: While generally intuitive, optimizing categorization rules might require some initial setup and refinement.

- Not a Full Accounting Suite: It focuses on statement processing and basic reporting, not invoicing, payroll, or inventory management like broader tools.

Smart Clerk vs. Alternatives (Quickbooks, Wave, Xero)

Tools like Quickbooks, Wave Accounting, and Xero are comprehensive accounting platforms offering a wide range of features beyond bank statement processing, including invoicing, payroll, inventory, and extensive integrations. They often rely on direct bank feeds or manual CSV uploads.

Smart Clerk differentiates itself by focusing intensely on the initial data extraction from PDF statements using AI. It’s less about being an all-in-one accounting system and more about being the *best* tool for getting that statement data processed quickly and accurately.

Consider Smart Clerk if:

- Your primary bottleneck is processing PDF bank/credit card statements.

- You need a fast way to generate basic P&L reports from statement data.

- You want an AI-driven tool specifically for data extraction and categorization accuracy.

- You use another accounting system but need a better way to import statement data.

- You are an accountant looking to speed up client onboarding and monthly processing.

It can work alongside tools like Xero or Quickbooks, handling the statement import efficiently before data is potentially moved to the main accounting system, or serve as a primary tool for simpler bookkeeping needs focused on P&L from bank activity.

Who Benefits Most from Smart Clerk?

Smart Clerk is particularly valuable for:

- Accountants & Bookkeepers: Drastically cut down time spent on manual data entry for multiple clients. Improve turnaround times and capacity to take on more clients. Provide cleaner data for higher-level advisory services.

- Small Businesses: Gain control over finances without needing extensive accounting knowledge. Quickly understand profitability and spending patterns. Simplify tax preparation by having organized, exportable data. This efficiency allows more focus on growth, perhaps exploring tools for planning like IdeaBuddy for new ventures.

- Solopreneurs & Freelancers: Manage business finances efficiently alongside other responsibilities. Eliminate the drudgery of manual bookkeeping. Get quick P&L insights to track performance and make informed decisions. Managing finances effectively is crucial, just like streamlining other operations, such as social media. Related: Streamline Social Media & Boost ROI with Sociamonials.

Essentially, anyone who deals with PDF bank statements and finds the manual processing a significant time sink can benefit from the automation Smart Clerk offers. Understanding the value of such tools often comes from understanding the broader SaaS landscape. Related: The Ultimate Guide to Lifetime SaaS Deals.

While tools like Smart Clerk handle your finances, managing your online presence is also key. You might wonder, “What is SiteGuru?” – it’s a different type of tool focused on website SEO audits, helping ensure your business gets found online by potential customers. It complements financial tools by driving growth. But today, our focus remains firmly on streamlining your bookkeeping with AI.

Getting Started with Smart Clerk

Using Smart Clerk is designed to be straightforward:

- Upload: Simply upload your PDF bank or credit card statements.

- Process: Let the AI automatically extract and log all transactions.

- Review & Categorize: Quickly review the extracted data. Use the AI’s suggested categories or apply your own. Set up rules for recurring transactions.

- Reconcile: Use the reconciliation module if needed to spot discrepancies.

- Report & Export: Generate P&L statements and export your clean data to Excel for sharing or further use. Sharing data efficiently is key, similar to how smart links optimize sharing in marketing. Related: Unlock Your Marketing Potential.

The platform focuses on minimizing the learning curve so you can start saving time almost immediately.

Conclusion: Master Your Bookkeeping with AI

Manual bank statement processing is a major drain on productivity for accountants, small businesses, and solopreneurs alike. Smart Clerk offers a powerful, AI-driven solution specifically designed to tackle this challenge head-on. By automating data extraction, categorization, and reporting from PDF statements, it saves invaluable time, reduces costly errors, and provides quick access to crucial financial insights.

If you’re tired of drowning in paperwork and want to reclaim hours spent on tedious data entry, Smart Clerk presents a compelling opportunity to streamline your bookkeeping process. It’s a focused, efficient tool that delivers tangible results, helping you keep your finances organized and ready for tax season or strategic decision-making.

Related Reading

Frequently Asked Questions (FAQ) about Smart Clerk

Is Smart Clerk secure? How is my financial data handled?

Security is paramount when dealing with financial data. While specifics should be confirmed on the official Smart Clerk website, tools like this typically employ encryption and secure cloud infrastructure to protect user data during upload, processing, and storage. Always review their privacy policy and security measures.

What types of bank statements does Smart Clerk support?

Smart Clerk is specifically designed to process PDF bank and credit card statements. Ensure your statements are in a standard PDF format for optimal results. Compatibility with scanned or image-based PDFs might vary.

How accurate is the AI categorization?

AI categorization is generally very accurate, especially as it learns from your corrections and rules. However, initial accuracy depends on the clarity of transaction descriptions on your statements. Expect to perform some review and refinement, particularly when starting, to train the AI for your specific vendors and spending patterns.

Can Smart Clerk replace my existing accounting software like Quickbooks or Xero?

It depends on your needs. Smart Clerk excels at automating bank statement processing and generating P&L reports from that data. If that’s your primary need, it might suffice. However, it doesn’t offer the full suite of features like invoicing, payroll, inventory management, or direct bank feeds found in comprehensive platforms. Many users find it works best as a powerful *complement* to their existing system, streamlining the initial data entry.

Is there a limit to the number of statements or transactions I can process?

Specific usage limits often depend on the plan or deal structure (like the lifetime deal mentioned). Review the terms of the offer for details on processing volume, number of clients/businesses supported, etc.

Software

Software