Share This Article

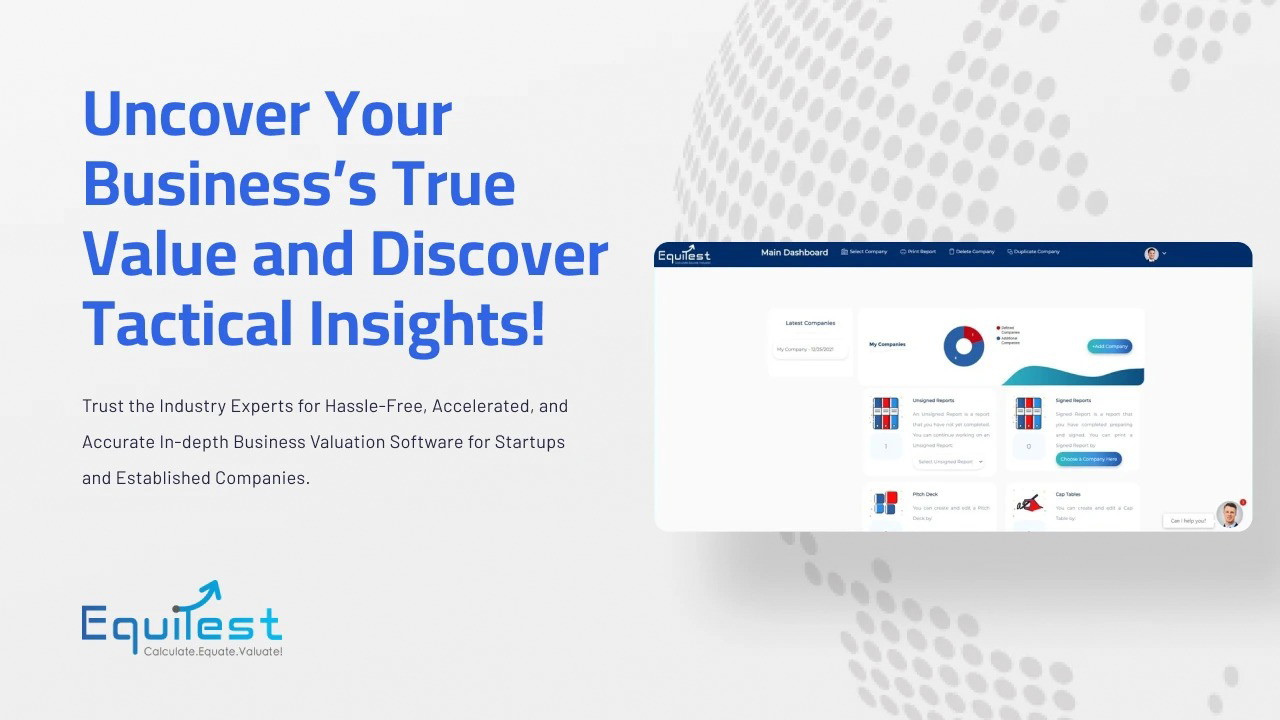

Navigating the complex world of business valuation can be a significant hurdle, especially for accountants, consultants, and SaaS founders who rely on accurate, timely assessments for critical decisions. Whether it’s for mergers and acquisitions, securing funding, strategic planning, or simply understanding a company’s financial health, the traditional valuation process is often notoriously slow, expensive, and resource-intensive. It demands deep financial expertise and countless hours, often putting high-quality valuation reports out of reach or delaying crucial business moves. What if there was a way to achieve the precision of top financial advisors but at a fraction of the time? Introducing Equitest – AI-Powered Business Valuation Platform, a revolutionary tool designed to empower professionals like you to generate comprehensive business valuation reports with unprecedented speed and accuracy.

What is Equitest? Understanding the AI-Powered Valuation Engine

Equitest – AI-Powered Business Valuation Platform is not just another financial tool; it’s a sophisticated software platform leveraging the power of Artificial Intelligence (AI) to automate and enhance the business valuation process. At its core, Equitest is designed to replicate the analytical rigor of seasoned financial experts but operates at machine speed. It allows users – primarily accountants providing advisory services, consultants guiding strategic decisions, and SaaS companies assessing their growth – to create detailed, reliable, and professional-grade business valuation reports without the traditional bottlenecks.

The platform integrates complex financial methodologies, market data analysis, and user-provided company specifics through an intuitive interface. By harnessing AI, Equitest can process vast amounts of data, identify patterns, apply relevant valuation models (like Discounted Cash Flow, Market Comparables, etc.), and generate comprehensive reports that are both easy to understand and robust enough for serious financial scrutiny. It aims to democratize access to high-quality business valuations, making it a feasible and efficient process for a wider range of businesses and financial professionals.

Why Accurate and Efficient Business Valuation is Crucial Today

In today’s dynamic business environment, understanding a company’s true worth isn’t just a financial exercise; it’s a strategic imperative. For accountants, offering valuation services extends their advisory capabilities beyond traditional compliance, enabling them to provide higher-value insights to clients considering sales, mergers, or seeking investment.

Consultants rely on accurate valuations to underpin their strategic recommendations. Whether advising on M&A strategy, fundraising, restructuring, or exit planning, a credible valuation forms the bedrock of sound advice. Delays or inaccuracies in valuation can derail deals or lead to suboptimal outcomes for clients.

For SaaS companies, particularly those in high-growth phases, regular valuation is essential. It informs fundraising negotiations, helps benchmark progress, provides a basis for employee stock options, and prepares the company for potential acquisition offers. Understanding valuation drivers allows founders and management teams to focus on activities that genuinely build enterprise value. Ignoring valuation can mean leaving significant money on the table during critical transactions.

The speed at which markets move, especially in the tech and SaaS sectors, means that valuations conducted months ago might already be outdated. The need for rapid, repeatable, and reliable valuation methods has never been greater.

The Stumbling Blocks: Challenges with Traditional Valuation Methods

Anyone who has commissioned or performed a traditional business valuation knows the inherent difficulties:

- Time-Consuming: Gathering data, building financial models, researching comparable transactions, and writing the report can take weeks, if not months.

- Expensive: Engaging experienced valuation professionals commands significant fees, often placing comprehensive valuations beyond the budget of smaller businesses or frequent needs.

- Complexity: Valuation methodologies require specialized knowledge. Selecting the right approach and applying it correctly involves expertise that many in-house finance teams or generalist accountants may lack.

- Data Intensive: Accessing reliable market data and comparable company information can be challenging and costly.

- Inconsistency: Different analysts might arrive at different conclusions based on subjective interpretations or variations in methodology application.

These challenges often lead to businesses relying on rough estimates, outdated valuations, or foregoing valuation altogether, potentially leading to poor strategic decisions or missed opportunities.

Equitest: The AI-Powered Solution to Valuation Bottlenecks

Equitest – AI-Powered Business Valuation Platform directly addresses the pain points of traditional valuation by leveraging technology. Here’s how it transforms the process:

- Speed: The core promise is generating reports “X100 Faster.” By automating data analysis and model application, Equitest drastically reduces the time required from weeks or months to potentially hours or days.

- Efficiency: It streamlines data input and processing, freeing up valuable time for accountants and consultants to focus on analysis, interpretation, and client advisory rather than manual calculations.

- Accessibility: While financial expertise is always valuable, Equitest makes sophisticated valuation methodologies accessible to users who may not be deep valuation specialists, thanks to its guided process and AI assistance.

- Consistency: AI algorithms apply methodologies consistently, reducing the variability often found in manual valuations.

- Data Integration: The platform is designed to integrate relevant market data and benchmarks, enhancing the reliability and context of the valuation.

Essentially, Equitest acts as a powerful analytical assistant, performing the heavy lifting of calculation and data processing, allowing professionals to focus on the strategic implications of the valuation results.

Key Features and Benefits of Equitest

Equitest packs a suite of features designed for efficiency and accuracy:

- AI-Driven Analysis: The platform’s core intelligence analyzes financial data, identifies trends, and applies appropriate valuation methodologies based on the company profile and industry context. Benefit: Reduces manual effort and potential for human error, ensures sophisticated analysis.

- Multiple Valuation Methodologies: Supports standard valuation approaches (e.g., DCF, Market Multiples, Asset-Based) allowing for comprehensive analysis and triangulation of value. Benefit: Provides robust, defensible valuation figures suitable for various purposes.

- Intuitive Data Input: Streamlined process for entering company financial data and qualitative information. Benefit: Saves time and reduces the complexity of getting started.

- Automated Report Generation: Creates professional, detailed valuation reports quickly, complete with charts, summaries, and methodology explanations. Benefit: Delivers client-ready or investor-ready documentation with minimal manual formatting.

- Market Data Integration (Implied): Likely incorporates relevant industry benchmarks and market comparables for context. Benefit: Ensures valuations are grounded in current market realities.

- Scalability: Suitable for valuing multiple businesses or performing periodic valuations efficiently. Benefit: Ideal for accounting firms with many clients, consultants managing multiple projects, or SaaS companies needing regular updates.

The cumulative benefit is clear: Equitest empowers users to perform high-quality business valuations faster, more efficiently, and potentially more affordably than traditional methods allow.

How Equitest Works: A Simplified Overview

While the underlying AI and financial models are complex, using Equitest is designed to be straightforward:

- Input Data: Users input key financial information (historical performance, projections) and qualitative details about the business (industry, market position, management team).

- Configure Parameters: Select relevant valuation methodologies or let the AI suggest appropriate ones. Adjust key assumptions if necessary.

- AI Processing: Equitest’s algorithms analyze the data, apply the chosen methodologies, and benchmark against relevant market data.

- Review & Refine: The platform presents preliminary results and insights. Users can review, potentially adjust inputs, and rerun analyses.

- Generate Report: Once satisfied, users generate a comprehensive valuation report, often customizable with branding.

This streamlined workflow dramatically accelerates the process compared to building models and reports from scratch.

Best Use Cases for Accountants, Consultants, and SaaS Companies

Equitest is particularly valuable for its target audience:

- Accountants:

- Expand Advisory Services: Offer business valuation as a new, high-value service line.

- Support Client Transactions: Provide timely valuations for clients undergoing sales, mergers, or seeking funding.

- Enhance Financial Planning: Use valuation insights to inform client strategic financial planning.

- Consultants:

- M&A Advisory: Quickly assess target companies or prepare clients for sale.

- Strategic Planning: Provide data-backed valuation context for strategic decisions.

- Fundraising Support: Help clients understand their worth and negotiate better terms with investors.

- SaaS Companies:

- Track Growth & Value: Monitor valuation changes over time as the company hits milestones.

- Prepare for Funding Rounds: Generate credible valuations for pitch decks and investor discussions.

- Inform Exit Strategy: Understand potential exit value and key drivers.

- Employee Stock Options (ESOPs): Establish a defensible basis for stock option pricing (Note: 409A valuations in the US have specific requirements; ensure Equitest aligns or supplements as needed).

It’s important to understand the scope of different business analysis tools. While financial valuation tools like Equitest focus on assessing a company’s monetary worth based on financials and market data, other tools analyze different aspects of a business. For instance, you might ask ‘What is SiteGuru?‘ if you’re looking for insights into your website’s SEO health and performance – a different but equally important area for online businesses, especially SaaS companies, as strong online presence can indirectly influence valuation multiples. Similarly, understanding How Smart Links Transform Your Brand and Boost Conversions can highlight marketing efficiencies that contribute positively to future revenue projections used in valuation.

Getting Started with Equitest

Embarking on AI-powered valuation with Equitest is designed to be user-friendly. Typically, the process involves signing up on their platform, choosing a suitable plan (details often available on their site or via lifetime deals sometimes found on marketplaces – see our guide on Where to Find the Best Deals), and then following the guided interface to input your first company’s data. The platform likely provides tutorials or documentation to help users navigate the features and understand the inputs required for different valuation methods. Given its focus on efficiency, the onboarding process aims to get users generating their first report relatively quickly.

Exploring The Ultimate Guide to Lifetime SaaS Deals might also uncover opportunities to access powerful tools like Equitest under favorable terms, enhancing the ROI for your practice or business.

Conclusion: Revolutionize Your Business Valuation Process

Business valuation no longer needs to be a protracted, expensive ordeal reserved only for major transactions. Tools like Equitest – AI-Powered Business Valuation Platform are democratizing access to sophisticated financial analysis, empowering accountants, consultants, and SaaS businesses to make data-driven decisions with confidence.

By harnessing AI, Equitest offers a compelling blend of speed, accuracy, and efficiency, transforming valuation from a bottleneck into a strategic advantage. Whether you’re looking to enhance client services, provide sharper strategic advice, or gain crucial insights into your own company’s growth trajectory, Equitest presents a powerful solution to streamline the process and unlock valuable financial intelligence.

Related Reading

Frequently Asked Questions (FAQ)

Is AI-powered valuation accurate?

AI valuation tools like Equitest aim for high accuracy by consistently applying established methodologies and integrating vast datasets. While they provide robust estimates, the results should always be reviewed by a professional, especially for high-stakes transactions. The AI enhances efficiency and consistency but doesn’t replace human judgment entirely.

What kind of data do I need to provide?

Typically, you’ll need historical financial statements (Income Statement, Balance Sheet, Cash Flow), future projections or forecasts, and qualitative information about the company’s operations, market, management, and industry.

Can I customize the reports?

Many platforms, likely including Equitest, offer options to customize reports with your own branding (logo, colors) and potentially add specific commentary or analysis sections.

Is Equitest suitable for official valuations (e.g., legal, tax purposes)?

While Equitest produces detailed reports based on standard methodologies, its suitability for official purposes (like 409A valuations in the US, legal disputes, or tax filings) depends on regulatory requirements and the specific use case. It’s often best used for internal decision-making, M&A screening, fundraising discussions, and client advisory, but may need to be supplemented or reviewed by a certified valuation analyst for formal requirements.

How does Equitest handle data security and confidentiality?

Reputable financial software platforms prioritize data security using encryption and secure hosting. You should review Equitest’s specific privacy policy and security measures to ensure they meet your standards, especially when handling sensitive client or company data.

Software

Software