Share This Article

Embarking on the entrepreneurial journey, whether as a freelancer, solopreneur, or someone just exploring the possibilities, often means navigating uncharted territory, especially when it comes to finances. The dream of independence and building something of your own is exhilarating, but managing cash flow, planning for taxes, and making smart investment decisions can feel overwhelming. Many find themselves so focused on delivering client work or developing their product that personal financial planning takes a backseat. Yet, mastering your financial future is not just a ‘nice-to-have’; it’s fundamental to sustainable success and long-term stability. If you’re looking for expert-led guidance tailored to the unique financial landscape of independent work, PRO$PER offers comprehensive courses designed specifically for smart investing and financial empowerment.

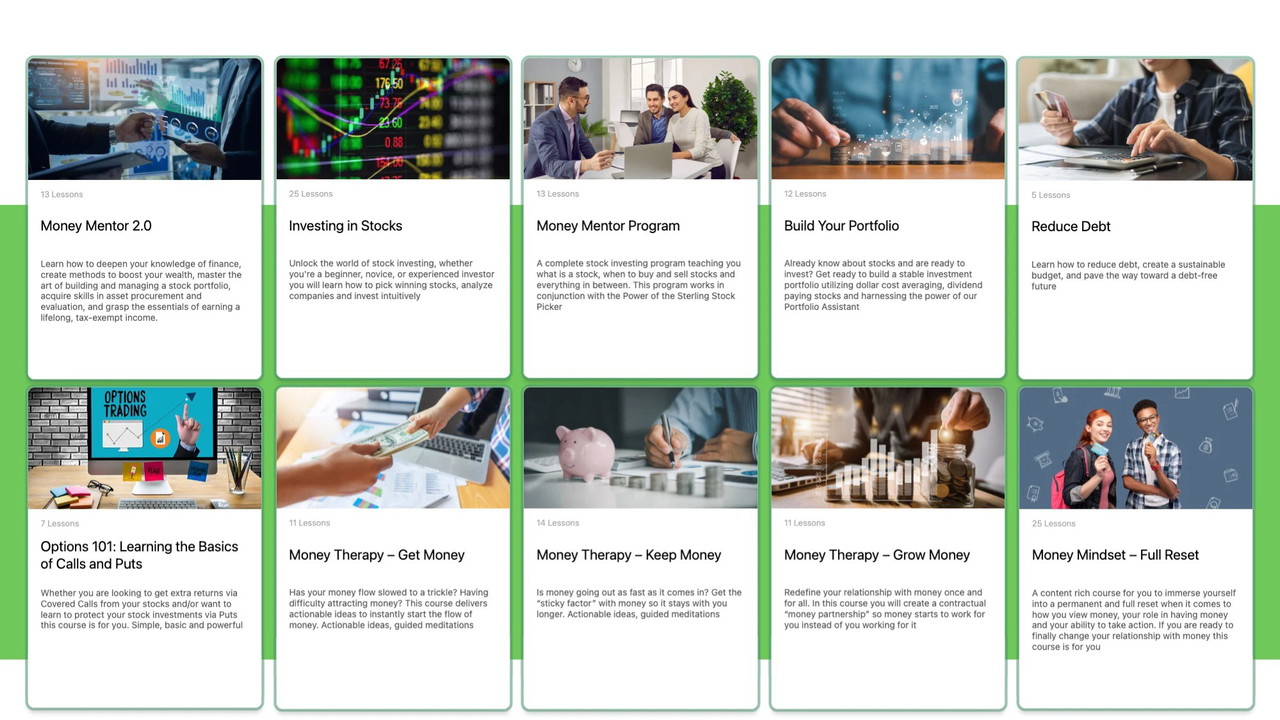

What Is PRO$PER?

PRO$PER is an educational platform offering expert-led courses focused on mastering personal finance and smart investing strategies. It’s designed to demystify complex financial concepts and turn them into actionable steps for building wealth. Unlike generic financial advice, PRO$PER aims to provide targeted knowledge, particularly beneficial for those navigating the variable income streams and unique financial challenges faced by the entrepreneur-curious, freelancers, and solopreneurs. It functions as a digital mentor, equipping users with the understanding needed to make informed investment decisions, manage money effectively, and cultivate a positive financial mindset.

Why Financial Literacy Matters for Entrepreneurs, Freelancers, and Solopreneurs

For those charting their own course in the business world, financial literacy isn’t just about balancing a checkbook; it’s about survival, growth, and achieving true freedom. Traditional employment often comes with predictable salaries, retirement plans, and benefits, providing a financial safety net. Freelancers and solopreneurs, however, face income volatility, self-funded retirement, irregular tax obligations, and the constant need to reinvest in their business.

Without a solid grasp of financial principles, common pitfalls emerge:

- Poor Cash Flow Management: Difficulty bridging gaps between project payments, leading to stress and potential debt.

- Inadequate Tax Planning: Facing unexpected large tax bills due to lack of quarterly estimations or understanding deductions.

- Missed Investment Opportunities: Keeping earnings stagnant in low-yield accounts instead of making them work harder through strategic investments.

- Underfunding Retirement: Failing to set up and consistently contribute to retirement accounts like SEP IRAs or Solo 401(k)s.

- Debt Accumulation: Relying on credit to manage inconsistent income or fund business expenses without a clear repayment strategy.

Mastering personal finance empowers independent professionals to smooth out income fluctuations, plan effectively for taxes, build long-term wealth through investing, and ultimately create a more stable and resilient business and personal life. It transforms financial uncertainty from a source of anxiety into an area of control and strategic advantage. This journey often starts with understanding foundational concepts, much like those exploring The Ultimate Guide to Lifetime SaaS Deals seek to understand the value proposition of different software models.

How PRO$PER Works: Your Path to Financial Mastery

PRO$PER simplifies the journey to financial competence through a structured, supportive, and personalized approach. It combines expert-led educational content with interactive tools to ensure learning translates into real-world action.

The core process involves:

- Foundation Building: Users start with courses covering fundamental concepts like stock market basics, different investment types (stocks, bonds, ETFs), risk assessment, and understanding economic indicators. This ensures everyone, regardless of prior knowledge, builds a solid base.

- Strategic Learning: The platform delves into specific investment strategies, company analysis techniques (fundamental and technical), and portfolio diversification methods. Lessons are designed by seasoned investors, offering practical insights rather than just theory.

- Personalized Guidance (Financial Success Profile & AI): PRO$PER utilizes a ‘Financial Success Profile’ to understand your unique goals, current financial situation, risk tolerance, and even your money habits. This profile helps tailor recommendations. Additionally, Finley AI, a personal financial coach, provides on-demand interactions, evaluations, and answers to your specific questions, making the learning process highly relevant.

- Mindset Transformation: Recognizing that financial success is partly psychological, PRO$PER includes content focused on developing a healthy relationship with money, overcoming limiting beliefs, and aligning financial habits with long-term goals.

- Action & Tracking: Learning is coupled with implementation. The platform encourages setting financial goals (like debt reduction targets or investment milestones) and provides tools to track progress, monitor completed lessons, and analyze performance, fostering accountability.

This blend of structured education, personalization through AI, mindset coaching, and progress tracking makes PRO$PER a comprehensive tool for anyone serious about taking control of their financial destiny.

Key Features & Benefits of PRO$PER

PRO$PER is packed with features designed to deliver tangible financial outcomes. Here’s a breakdown of what it offers and the benefits for users:

- Expert-Led Investment Courses:

- Feature: Comprehensive lessons on stock market fundamentals, investment strategies, and company analysis methods taught by experienced investors like Jaden Sterling.

- Benefit: Gain the confidence and knowledge to make informed investment decisions, moving beyond guesswork and potentially growing wealth more effectively. Avoid common pitfalls and understand market dynamics.

- Money Mindset Mastery:

- Feature: Content and exercises focused on understanding your relationship with money, identifying limiting beliefs, and developing healthier financial habits.

- Benefit: Shift from financial stress to a mindset of abundance and control. Make financial decisions that align with your values and long-term goals, reducing emotional spending or avoidance.

- Financial Success Profile & Finley AI Coach:

- Feature: A personalized assessment of your financial goals and habits, coupled with an AI assistant (Finley AI) for tailored interactions, evaluations, and recommendations.

- Benefit: Receive guidance relevant to your specific situation, not generic advice. Get answers to your questions quickly and stay motivated with personalized feedback.

- Debt Reduction Strategies:

- Feature: Practical guidance on creating sustainable budgets and implementing proven strategies for debt repayment (e.g., snowball or avalanche methods).

- Benefit: Systematically reduce financial burdens like credit card debt or loans without feeling overwhelmed. Achieve greater financial stability and free up cash flow for saving or investing.

- Progress Tracking & Optimization:

- Feature: Tools to monitor completed lessons, track progress towards financial milestones (e.g., savings goals, debt paid off), and analyze performance.

- Benefit: Stay accountable and motivated by seeing tangible results. Identify what strategies are working and adjust your approach based on data, optimizing your path to financial growth.

Pros and Cons of PRO$PER

Like any educational tool, PRO$PER has its strengths and considerations:

Pros:

- Expert Guidance: Content is created by experienced financial professionals, lending credibility and practical value.

- Holistic Approach: Addresses not just the ‘how-to’ of investing but also the crucial ‘money mindset’ aspect.

- Personalization: The Financial Success Profile and Finley AI tailor the experience to individual needs and goals.

- Action-Oriented: Focuses on translating knowledge into actionable steps with features like progress tracking and debt reduction strategies.

- Targeted Audience Focus: Particularly relevant for those with non-traditional income streams like freelancers and solopreneurs.

Cons:

- Requires Commitment: Like any educational program, results depend on the user’s dedication to completing courses and implementing strategies.

- Focus on Education, Not Direct Management: It teaches you how to invest and manage money but doesn’t manage your portfolio directly (which may be a pro for those wanting control).

- Newer Platform Dynamics: As with many evolving platforms, user experience and feature depth may continue to develop over time.

Best Use Cases for PRO$PER

PRO$PER is particularly well-suited for:

- Entrepreneur-Curious Individuals: Those thinking about starting a business or side hustle who want to build a strong financial foundation before taking the leap. Understanding personal finance is key before managing business finance.

- Freelancers: Professionals juggling multiple clients and variable income streams who need strategies for budgeting, tax planning, saving, and investing with fluctuating cash flow.

- Solopreneurs: One-person business owners who wear all the hats, including CFO, and need efficient ways to learn investment strategies and manage both personal and business-related finances effectively.

- Anyone Seeking Financial Empowerment: Individuals at any stage who feel intimidated by investing or unsure how to manage their money effectively and want structured, expert guidance.

- DIY Investors: People who prefer to manage their own investments but lack the formal knowledge or confidence to do so effectively. PRO$PER provides the educational framework they need.

Integrating Financial Strategy with Business Goals

For entrepreneurs, freelancers, and solopreneurs, personal financial health is intrinsically linked to business sustainability and growth. Effective financial planning learned through platforms like PRO$PER isn’t just about personal wealth building; it directly impacts your business decisions.

Consider how mastering your finances enables better business strategy:

- Investment Decisions: Understanding investment principles can help you evaluate opportunities not just in the stock market, but also when considering reinvesting profits back into your business (e.g., new equipment, marketing campaigns, hiring).

- Pricing and Profitability: A clear grasp of your personal financial needs informs how you price your services or products to ensure sustainable profitability.

- Risk Management: Building a personal financial safety net (emergency fund, diversified investments) allows you to take calculated risks in your business without jeopardizing your personal stability.

- Long-Term Vision: Aligning personal retirement goals with business exit strategies or long-term growth plans ensures both aspects are working in harmony.

Just as entrepreneurs use specific tools to understand different facets of their business – perhaps asking ‘What is SiteGuru?‘ to analyze website health and SEO performance – understanding your financial health requires dedicated tools and knowledge. PRO$PER provides that analytical lens for your finances, empowering you to make integrated decisions that benefit both your personal wealth and your business success. Similarly, understanding how tools like smart links impact conversions, as discussed in Unlock Your Marketing Potential, ties marketing efforts back to the financial bottom line.

How to Get Started with PRO$PER

Beginning your journey towards financial mastery with PRO$PER is straightforward:

- Visit the Platform: Click through to the PRO$PER website.

- Sign Up/Enroll: Follow the prompts to create your account and enroll in the program. Look for any available special offers or lifetime deals that might enhance value.

- Complete Your Profile: Take the time to fill out the Financial Success Profile accurately. This is key to receiving personalized recommendations.

- Explore the Courses: Start with the foundational courses to build your knowledge base. The platform is typically structured logically, guiding you through modules.

- Engage with Finley AI: Don’t hesitate to use the AI coach. Ask questions, seek clarification, and request evaluations based on your learning and goals.

- Set Goals & Track Progress: Utilize the tracking tools to set specific, measurable financial goals (e.g., save $X amount, pay off Y debt, complete Z investment modules) and monitor your achievements.

- Implement & Iterate: Apply what you learn. Start budgeting, exploring investment options, or implementing debt reduction strategies. Use the platform’s analytics to see what’s working and adjust as needed.

Consistency is key. Dedicate regular time slots to learning and applying the principles taught in PRO$PER to see the best results.

Conclusion: Take Control of Your Financial Future

For the entrepreneur-curious, freelancers, and solopreneurs, navigating the financial landscape doesn’t have to be a source of stress. With the right knowledge and tools, you can transform uncertainty into empowerment. PRO$PER offers a structured, expert-led pathway to understanding complex financial concepts, mastering smart investing, changing your money mindset, and building long-term stability.

By investing in your financial literacy, you’re investing directly in the resilience and potential of your entrepreneurial journey. You gain the confidence to make informed decisions, the strategies to grow your wealth, and the control to design a future aligned with your goals. Stop letting financial complexity hold you back.

Related Reading

Frequently Asked Questions (FAQ)

Is PRO$PER suitable for complete beginners in finance and investing?

Yes, PRO$PER is designed to cater to various levels, including beginners. It starts with fundamental concepts and builds up to more advanced strategies, ensuring a solid foundation for everyone.

How is PRO$PER different from free financial advice online?

PRO$PER offers structured, expert-curated courses, personalized guidance through its Financial Success Profile and AI coach, and a focus on both strategy and mindset. This provides a more comprehensive and tailored learning experience compared to fragmented, generic advice often found online.

Does PRO$PER provide specific stock recommendations?

PRO$PER focuses on teaching you *how* to analyze companies and make informed investment decisions based on proven strategies and data-driven methods, rather than providing direct stock picks. It empowers you to become a self-sufficient investor.

What kind of support is available within the platform?

Support includes the Finley AI financial coach for personalized interactions and Q&A, progress tracking tools, and potentially community features depending on the platform’s current offerings.

Can I access the course content at my own pace?

Typically, platforms like PRO$PER allow users to access course materials on demand, letting you learn at a pace that fits your schedule. This is particularly beneficial for busy freelancers and entrepreneurs.

Are there any prerequisites to joining PRO$PER?

No specific financial prerequisites are generally required. A willingness to learn and commit time to the material is the primary requirement.

Software

Software